All Categories

Featured

Table of Contents

A basic entire life plan has a degree yearly costs that have to be paid every year for as long as the guaranteed lives. Entire life insurance policy accumulates an internal cash value that reduces the quantity of fatality benefit the insurer has at risk. If a plan is surrendered, the cash value would certainly be paid to the proprietor.

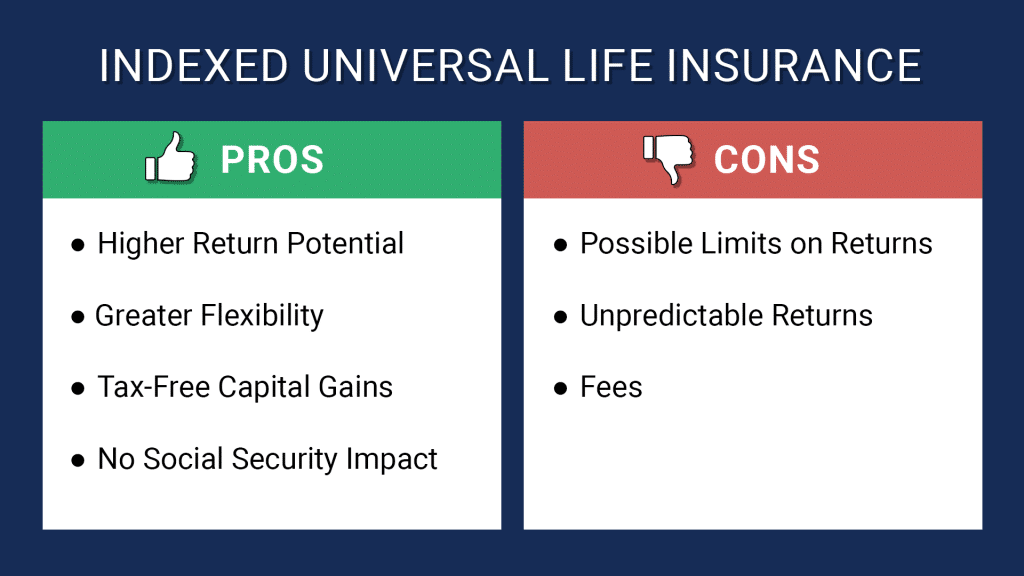

Money values of an entire life policy can never regress, no matter of outside market conditions. These worths collect at commonly a much lower average rate than an IUL.

Also, plan payments and superior payments are flexible making them attractive for tax obligation functions due to its tax-deferred development; cash money worth won't reduce if the target index drops - IUL calculator. On the various other hand, premium payments in a whole life policy are normally fixed and can not transform throughout the life of the policy

The information and descriptions included right here are not intended to be total descriptions of all terms, problems and exclusions suitable to the services and products. The accurate insurance policy coverage under any kind of nation Investors insurance policy item is subject to the terms, conditions and exclusions in the actual plans as provided. Products and solutions described in this site differ from one state to another and not all items, coverages or services are available in all states.

Why do I need Indexed Universal Life Companies?

Please refer to the plan contract for the specific terms and conditions, specific details and exemptions - IUL account value. The plan stated in this details sales brochure are protected under the Policy Owners' Protection Plan which is provided by the Singapore Deposit Insurance Firm (SDIC).

To find out more on the sorts of advantages that are covered under the plan as well as the restrictions of coverage, where suitable, please call us or check out the Life Insurance coverage Association, Singapore or SDIC sites () or (www.sdic.org.sg). This ad has actually not been evaluated by the Monetary Authority of Singapore.

This file is indicated for basic info just. No part of the info here will be customized, removed, recreated or shown any individual or entity without the prior written approval of Sun Life. No circulation plan, agreement of insurance coverage or any various other legal relationships is created or can be understood to be developed entailing Sun Life and you, solely due to the information here and without a correct arrangement being participated in in writing and duly carried out.

Even More, Sun Life does not think any type of responsibility, and has no obligation, to upgrade this paper or inform recipients of its updated components in due course, if any of its materials changes. Sun Life is not accountable for any kind of loss, problems or expenses that may be incurred from reliance upon the components herein.

How do I compare Tax-advantaged Indexed Universal Life plans?

This document does not comprise solicitation or a deal to acquire any kind of item discussed here - Indexed Universal Life account value. The viability of a product for anyone requires to be considered bearing in mind the relevant individual's very own conditions and needs, and as such, competent expert consultants, such as legal representatives, accounting professionals, tax obligation and economic experts, need to be involved by the relevant individual as (s)he regards fit before (s) he chooses whether or not to acquire any item

Distributors have the single responsibility to acquaint themselves in any way times with, and abide fully with, pertinent legislations, policies and various other requirements, as appropriate, in connection with dispersing insurance policy items. Sunlight Life Assurance Firm of Canada is an insurer government included in Canada, with OSFI Organization Code F380 and its licensed office at 1 York Street, Toronto, Ontario, Canada M5J 0B6.

Why is Iul Protection Plan important?

Sun Life Guarantee Firm of Canada Singapore Branch (UEN T19FC0132B) is registered with the Bookkeeping and Corporate Regulatory Authority of Singapore as an international firm, with its authorized office at One Raffles Quay, # 10-03 North Tower, Singapore 048583. It is accredited and managed by the Monetary Authority of Singapore. Where Sunlight Life Assurance Business of Canada Singapore Branch is described as "Sun Life Singapore", this is strictly for marketing and branding purposes only, and no lawful relevance is expressed or suggested.

A repaired indexed universal life insurance (FIUL) plan is a life insurance policy item that provides you the chance, when properly funded, to take part in the growth of the marketplace or an index without directly buying the market. At the core, an FIUL is created to supply protection for your enjoyed ones in the occasion that you die, but it can also supply you a wide selection of benefits while you're still living.

The main distinctions in between an FIUL and a term life insurance coverage plan is the adaptability and the benefits beyond the death advantage. A term plan is life insurance policy that assures repayment of a specified death advantage during a given duration of time (or term) and a specific premium. When that term expires, you have the alternative to either renew it for a new term, end or transform it to a premium protection.

An FIUL can be utilized as a safeguard and is not a replacement for a long-lasting healthcare plan. Be certain to consult your economic specialist to see what sort of life insurance coverage and advantages fit your requirements. A benefit that an FIUL supplies is assurance. You can relax ensured that if something happens to you, your family and enjoyed ones are dealt with.

What does a basic Iul Account Value plan include?

You're not revealing your hard-earned money to an unpredictable market, producing for yourself a tax-deferred asset that has integrated security. Historically, our company was a term provider and we're devoted to offering that company however we've adjusted and re-focused to fit the changing requirements of consumers and the needs of the sector.

It's a market we've been devoted to. We've devoted sources to developing some of our FIULs, and we have a concentrated initiative on having the ability to give strong solutions to customers. FIULs are the fastest expanding sector of the life insurance policy market. It's a space that's growing, and we're mosting likely to keep at it.

Returns can expand as long as you proceed to make settlements or keep a balance.

Unlike global life insurance, indexed global life insurance coverage's cash worth makes passion based upon the efficiency of indexed stock markets and bonds, such as S&P and Nasdaq. It isn't directly spent in the stock market. Mark Williams, CEO of Brokers International, mentions an indexed universal life policy resembles an indexed annuity that feels like universal life.

Latest Posts

Universal Life Insurance Florida

Iul Life Insurance Cost

Indexed Universal Life Insurance Companies